US Telecoms Quick Take: Who wants US Cellular?

What’s new: US Cellular (USM) announced a strategic review of its wireless business on Friday. We don’t cover USM or TDS, and we are not taking a view on potential transactions, or on the stocks. We did do a quick review of their spectrum portfolio with thoughts on what it might be worth and who it might fit best with in this brief note.

For Blair's thoughts on the policy angle, see here.

Background

We have never covered USM. From a respectful distance, we have always thought it would see its highest and best value in combination with one of the national carriers. In all our conversations with management over the last two decades, we got the impression that the controlling family had no interest in selling. It seems they have changed their mind.

The logic

Competing as a regional operator against three well-resourced national carriers plus Cable has been tough. At the same time, the strategic and financial synergies from combining with a national carrier would be significant. On the strategic front, USM’s spectrum portfolio plugs holes in the holdings of the three national carriers. On the financial front, the subscribers could be moved across to the acquirer and the USM network shutdown, eliminating USM’s fixed costs.

In this initial note, we will just take a view on the spectrum. We will return in due course with thoughts on cost synergies, and other assets like towers.

The spectrum portfolio

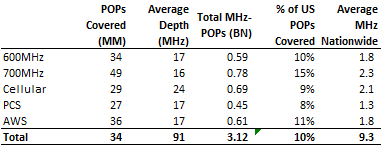

USM has spectrum licenses in one third of all Cellular market areas (CMAs), with holdings than span the 600MHz, 700MHz, Cellular, PCS, AWS, CBRS, 3.45GHz, C-Band, 24GHz, 28GHz, 37GHz and 39GHz bands. We started with a quick analysis of all their holdings below 3GHz (we will follow up on the rest in due course).

For the spectrum below 3GHz, they average about 90MHz in the markets where they have licenses, and these markets cover 34MM POPs on average, for a total of ~3.1BN MHz-POPs. The biggest concentration of licenses is in the Midwest; the largest markets are in Wisconsin and Missouri. The largest holdings below 3GHz are in 700MHz and Cellular.

Table 1: US Cellular Spectrum Holdings

Strategic fit

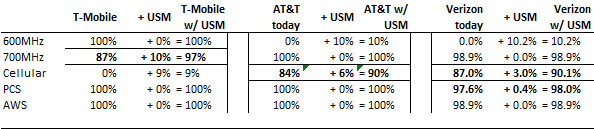

All spectrum is valuable to all carriers. It is often cheaper for carriers to deploy spectrum in bands that they have already deployed. The most valuable licenses will be those that plug holes in bands that are strategically important to the carrier.

With that as backdrop, the 700MHz and Cellular licenses may be of most strategic value to the national carriers. 700MHz plugs holes in T-Mobile’s network, while the Cellular licenses plug holes in AT&T and Verizon’s networks.

The 600MHz, PCS and AWS don’t appear to plug any major holes, although Dish and T-Mobile have deployed 600MHz, and all three national carriers have deployed PCS and AWS.

Table 2: Population Coverage of Spectrum Holdings by Carrier, with and without US Cellular Holdings

(% of US Population)

Valuation

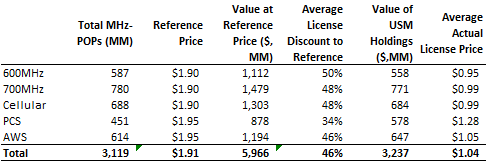

We value the licenses through the following process:

- We establish the premium or discount paid for the relevant market to the national average price paid at FCC spectrum auctions.

- We pick a reference transaction to set the national price for each of low-band (600MHz / 700MHz / Cellular) and lower mid-band (AWS / PCS).

- The value of each license is the premium or discount paid at auction, applied to the reference price from the reference transaction or auction.

For low-band, we picked the price T-Mobile recently paid for 600MHz spectrum from Columbia Capital. We reverse the process described above to get the national average price of $1.90 / MHz-POP, and then we work through the process above to price each USM license.

For lower mid-band, all the reference transactions are controversial. We averaged the national average price paid for all of AWS-3 at auction, excluding the licenses bought by Dish ($2.52 / MHz-POP), with the implied national average price we think AT&T paid for Leap’s spectrum ($1.36 / MHz-POP), for a national average price of $1.95 / MHz-POP.

Based on this framework, we estimate that the USM portfolio is worth $3.2BN ($1.04 / MHz-POP).

Table 3: Valuing US Cellular Licenses

Conclusion

The best fit may be with T-Mobile. At the values we have assumed here, the most strategically relevant band accounts for 24% of the total value of the portfolio. They would also pick up additional capacity in 600MHz, PCS, and AWS. They would likely sell the Cellular spectrum to AT&T or Verizon.

Having said that, Cellular has always been a particularly valuable band for Verizon and AT&T. USM’s Cellular only accounts for 22% of the value of the portfolio. They would likely divest the 600MHz to T-Mobile, and potentially the 700MHz also.

The subscribers and other assets have discrete value from the spectrum in this transaction, because any of the national carriers could accommodate the USM subscribers on their network without USM’s spectrum. The value of the subscribers and other assets could increase the value we show here considerably. We will provide thoughts on that in due course.

We think the most likely transaction partner would be one of the three national carriers. There is the prospect of a deal with Dish, if USM’s network materially accelerated Dish’s progress towards their next FCC deadline. We think the odds of this are very small; there is only one overlapping band (600MHz); and the network architectures are incompatible. USM would presumably have to be willing to take stock in a Dish deal. We would rule out Cable as a buyer entirely.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.