Telefonica: Peru insolvency could be material for TEF’s FCF guidance

We still await more details on any change of strategy from the new CEO, but the process of trying to “clean up” Telefonica Hispam seems to be accelerating and Telefonica has now announced that Peru will go into insolvency proceedings.

In this note, we review what this means and show that the outcome could help Telefonica to hit their €3bn 2026 FCF guidance and drive a near-term uplift to consensus FCF numbers.

The exit from Hispam continues

Telefonica has stated that its core geographies are Spain, Germany, Brazil and UK.

This means that its Telefonica Hispam division (formed by the Group's operations in Colombia, Mexico, Venezuela, Ecuador, Argentina, Chile, Peru and Uruguay) is essentially non-core for Telefonica, meaning that Telefonica is actively looking at inorganic actions for these assets that could help to unlock better value for Telefonica than remaining in their current form. For example:

- In Colombia, Telefonica originally set up a fibre JV with KKR, and also a network sharing agreement with Millicom. Now the whole asset is due to be sold to Millicom with an implied EV of €1.3bn (5.8x EBITDAaL).

- In Chile, Telefonica also set up a separate fibre JV with KKR and is exploring joint corporate action with AMX to buy into WOM’s Chapter 11 bankruptcy process.

- There have also been increasing press stories in recent weeks that Telefonica is looking to sell its assets in Argentina and Mexico with offers apparently having been received.

- In Peru, Telefonica had set up a separate FTTH asset, called Pangea, and back in 2023 had proposed to sell a 64% stake to KKR and Entel for €200m (at an estimated 12x EBITDAaL). However, this deal was blocked by the competition authorities, and Telefonica also has the added complication of external bonds which started to become due for repayment in April 2025, but the fundamentals had deteriorated significantly and there are still material outstanding local tax balances due. As a result, Telefonica has now decided to put this asset into an insolvency process.

Peru insolvency move is a half-way solution for now

In November, we wrote in detail on the Peru situation highlighting the fact that the local Peruvian bonds are starting to come due in April this year, which would be a trigger for some kind of decision, ie are the bonds repaid or not.

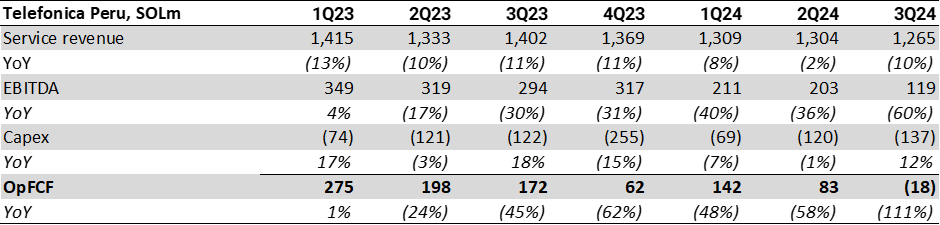

The problem for Telefonica in Peru is that the underlying business is in a poor condition due to increasing competition with revenues and EBITDA declining. Recently service revenues were down -11% YoY in 2023 and -7% YoY in 9M24. EBITDA was down -20% in 2023, which has deteriorated further to -45% in 9M24. Based on current trends, we forecast for 2024 EBITDA margin to be just 13% of service revenue (23% in 2023, 26% in 2022). Capex has been broadly stable in recent years, putting pressure on OpFCF – which turned negative in 3Q24.

Weak operating trends in Peru recently

Not only has Telefonica faced tough recent operational trends in Peru, but Telefonica has also been subject to a longstanding legal case of taxes due back to 2000.

In 2023 and 2024, Telefonica finally started to pay €424m (c. SOL1.7bn) of these dues, but there is a further €600m (c.SOL2.4bn) to potentially pay.

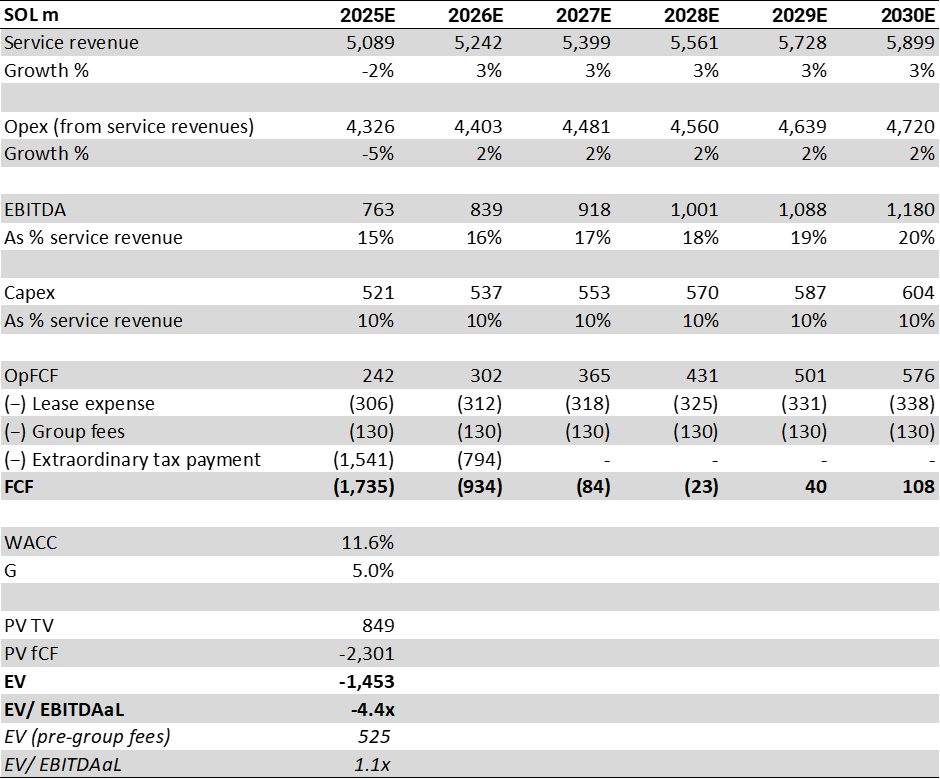

As a result, our base case valuation for the asset is negative SOL1.45bn (and this assumes a modest operational turnaround which might not be delivered), and therefore the asset is unable to meet its current debt obligations of SOL2.9bn. Of these debt obligations, SOL1.7bn refers to an international bond, which is due for repayment in three equal tranches in April 2025, 2026 and 2027 – hence the trigger for a decision to be taken now.

Negative underlying value for Peru (pre-debt obligations)

Given this outlook, we wrote in November that the economically rational decision for Telefonica would have been to walk away from the asset completely and hand control over to the bondholders. However, we thought that politics and “responsible capitalism” might have led Telefonica to maintain ownership of the asset and allow for the asset to be refinanced.

In the end, Telefonica has decided on a half-way solution – rather than handing the asset completely over to the bondholders right away, Telefonica is putting the asset into an insolvency procedure but what we hadn’t expected is that Telefonica is providing SOL1.6bn of loan capital over the next 18 months in order to meet purely operational needs.

This new capital from Telefonica will then rank pari passu with the other bondholders – and for Telefonica, there is now clearly a risk that this new loan capital won’t be repaid at the end of the restructuring process.

Details of the insolvency process: Embarking on this process means that during this process no debt will be repaid, no interest will be paid on the debt and none of the extraordinary tax provisions will be paid either and these will all become creditors in c.18 months time when a future restructuring plan is presented.

Technically, the filling of the ordinary procedure triggers an event of default. However, after the granting of the ordinary insolvency procedure (which is expected to take 90 business days), there will be a stay on all creditors pending the approval of the restructuring plan in a future creditors meeting. In the meantime, bondholders could try to go through the Peruvian courts to trigger a bankruptcy/liquidation of the company. However, in practice they are very likely to be discouraged given that this is a very lengthy process (over 12 months) by which time the stay would have been granted already.

At the end of the c.18 month process, a creditors meeting will be called where by the company will present its restructuring plan to creditors (ie a new business plan) and a proposal to all creditors to restructure their claims.

In the meantime, there might also be an extraordinary event, ie potential in-market consolidation as an exit route and we have often wondered whether they could sell out to the fourth-player Bitel, which is supported by the Vietnamese Government and might well be willing to fund such a transaction – but by taking this insolvency step now, it seems as if this is off the table for the time being. It could well be that Bitel (quite rightly) didn’t want to get involved in a messy creditor process and might only be interested in consolidation once the balance sheet has been “normalised”.

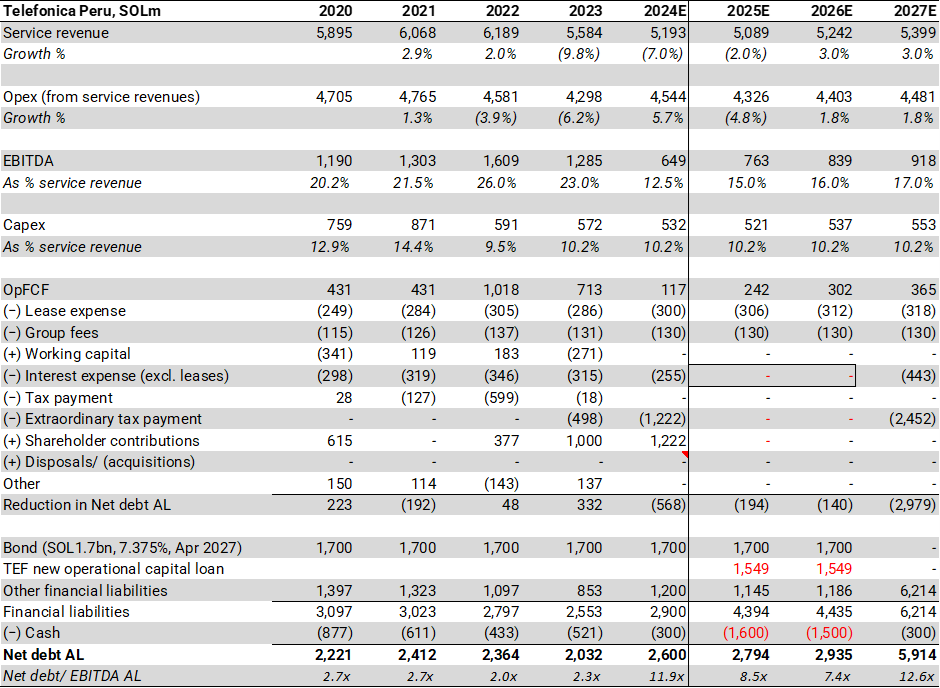

New forecasts for Telefonica Peru: still a looming creditor issue at end 2026

Based on this decision we show below new cashflow forecasts for Telefonica Peru showing the additional SOL1.5bn credit note being issued by Telefonica, the delay in payment of tax contingencies to 2027, the cessation of any interest payments and also no repayment on the SOL1.7bn international bond.

What we do notice though is that with the new Sol1.5bn credit injection from Telefonica, the underlying cash position of the asset would seem to be reasonably strong, suggesting that Telefonica might see a worse operational outlook that we are currently forecasting and are therefore wanting to give the asset more financial headroom.

However, given the existing creditor claims, Telefonica’s new credit claim and the payment of the extraordinary tax fines, there is still a huge looming problem for the asset in late 2026/ early 2027 when a far greater source of capital will need to be found.

Revised Telefonica Peru forecasts for insolvency

Tough outlook ahead now for the pre-existing bondholders

For the existing Telefonica Peru SOL1.7bn bondholders, this will mean that their future claim on the asset will now be diluted to sit alongside Telefonica’s new SOL1.5bn claim – albeit if our forecasts below are right, potentially not all of the SOL1.5bn credit facility will have to be drawn down. Given our negative EV for the asset on an underlying basis and including the tax penalties, we now see a tough negotiating round ahead for the SOL1.7bn bond creditors when a new plan is ultimately put forward, but the last quoted price of 57% of face value would appear to be optimistic absent an in-market consolidation outcome.

Impact on Telefonica Group – likely upside to reported FCF numbers

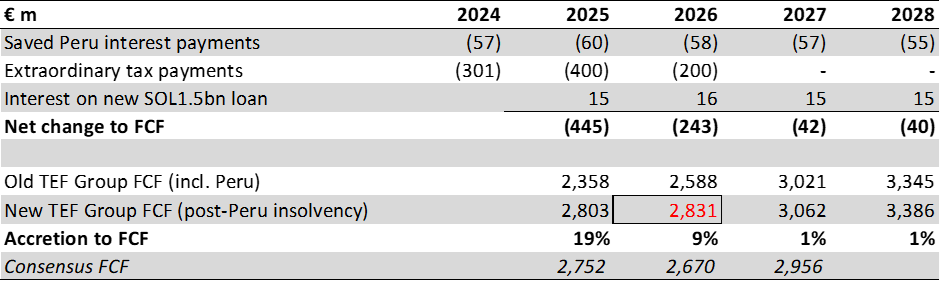

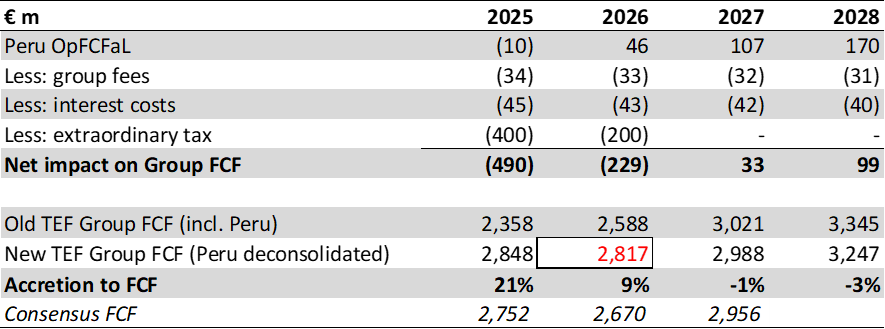

If we then compare this outcome with what is in our current model, this insolvency process will help Telefonica to save on the material extraordinary tax payments (which were to be booked in FCF) and also to save on net interest costs.

Hence, we think this process can be materially accretive to reported FCF in 2025 and 2026 (albeit we don’t have clarity on what will come after 2026 yet). Given Telefonica’s guidance of €3bn FCF in 2026, this move would now give us far more confidence that they should be able to get close to the target.

We don’t have enough visibility on exactly what is included in consensus numbers for these specific line items (and in particular, the Peru tax claims), but we believe consensus of €2.7bn of FCF in 2026 could now prove to be on the low side as a result of this move.

Peru insolvency process should materially support Group FCF

Potential deconsolidation effects to come

There might also be a further step to follow, depending on the auditor treatment of this situation which could be:

- A full deconsolidation of the Peruvian business

- A potential deconsolidation of the whole of Telefonica Hispam if several countries in the unit (all of them representing a material portion of Telefonica Hispam) are either in a sale process or in a situation like the one in Peru

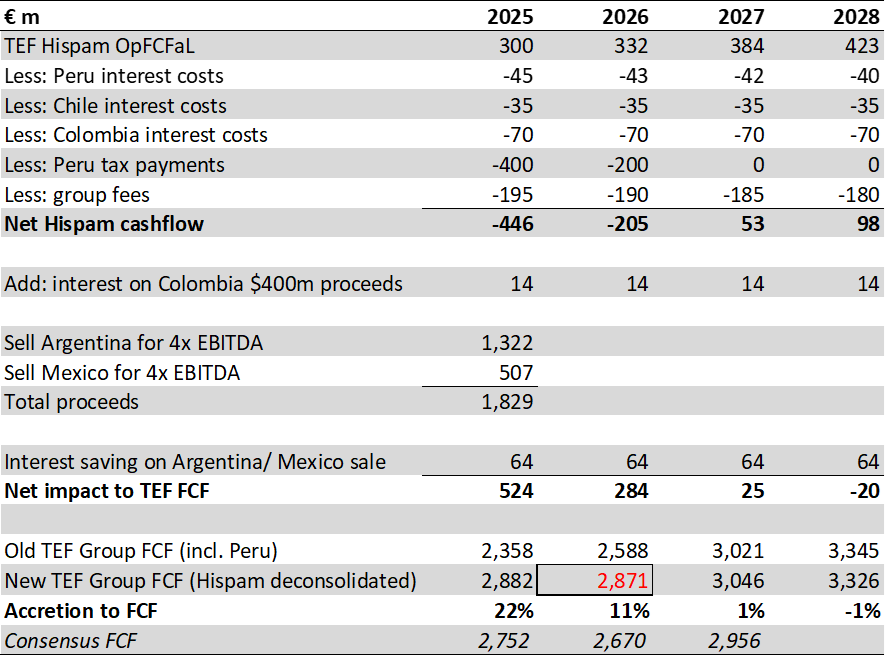

If we look first at the scenario where Peru becomes deconsolidated – but assume it is still operationally functional and paying its intra-group fees back to Telefonica then this could also increase our 2026 FCF estimate from €2.6bn to €2.8bn, ie similar to the insolvency process outcome above.

Peru deconsolidation could take 2026 FCF up to €2.8bn

However, if we end up in a scenario where the whole of Telefonica Hispam is deconsolidated, then even though some of the assets within the division are cash generative pre-group fees, when the impact of the local interest payments is included, such a move could be marginally more cash generative, especially if Telefonica is able to complete sales in Mexico and Argentina – albeit we would caveat that any sale in Argentina might be complicated in terms of the process of getting proceeds out of the country.

In this scenario, then we could be able to reach €2.9bn of 2026 FCF, ie exceptionally close to the official guidance of €3bn – and in all of these scenarios, it would be ahead of consensus.

Full deconsolidation of Hispam (and asset sales in Argentina/ Mexico) could be most accretive for FCF

We might hear more on this accounting treatment for this with the full year results. Given insolvency proceedings in Peru might be a niche topic for some, this could explain the muted share price reaction to today’s announcement, but given how often share prices can move when consensus numbers change, we believe today’s share price reaction might not be factoring in the real impact of this potential change.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.