GOOGL First Take: Capex guide overshadows Search & Margins

What’s New: In this first take following tonight’s results, we touch on:

- Capex guide/GCP capacity constraints = stronger potential of for Cloud revenue acceleration

- Search & Other strong as AI Overviews drawing more younger users

- Margins beat but D&A is coming home to roost in 2025

- YouTube and Cloud run-rate at $110B, with YouTube TV price increase helping

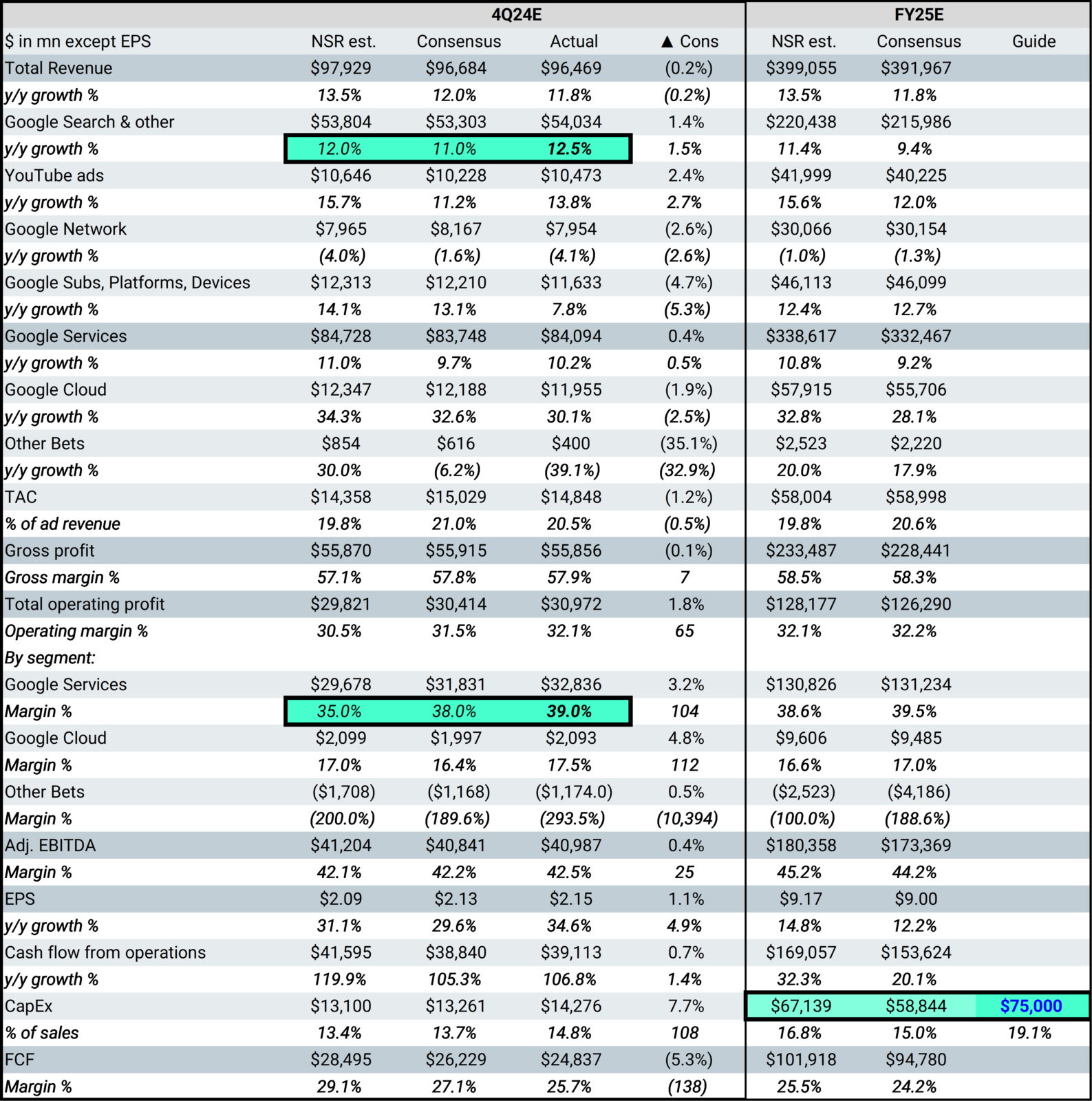

4Q24 Results vs. New Street Estimates and Consensus

Source: Company reports, FactSet consensus and New Street estimates

Capex guide/GCP capacity constraints = stronger potential for Cloud revenue acceleration

2025 capex guidance calling for $75B was the big headline tonight, well above consensus of $58.8B and also ahead of our Street-high $67.1B estimate. We note that last quarter’s early 2025 guide was only for “slower y/y growth” than in 2024, leaving a wide range for investor opinion and which we think contributed to some disappointment, reflected in the after-hours negative move, as investors digest the implications to FCF (and depreciation/operating margins).

We think this disappointment is misplaced, as GOOGL continues to carry a disproportionate opportunity in AI Cloud Infrastructure relative to peers (given its smaller base in traditional workloads) and Google’s TPU remains at a significant competitive advantage relative to other custom silicon peers.

4Q24 growth was impacted by capacity constraints on generative AI infrastructure, in addition to lapping a large deployment in 4Q24. With the announcement that a customer is currently live using Blackwell chips, we now have a line of sight into a new cycle of deployments this year which, based on our bottom-up hourly pricing work (see HERE) we believe implies a natural capacity to reaccelerate revenue in 2025.

In short, we took a higher capex investment in 2025 as a positive based on our work implying strong internal margins and ability to drive per-chip revenue in the face of sustained customer demand. CEO Pichai’s comment that AI workloads are shifting further to inference, and repeated callouts of their price-performance advantage in both efficient frontier models and infrastructure architecture (partially in response to questions about the impact of DeepSeek) are important and could be creating an underappreciation of the revenue potential for Google Cloud based on this guide.

As a result, we are incrementally positive, notwithstanding a likely down-step in our FCF estimates owing to the higher capex guide.

Search & Other strong as AI Overviews drawing more younger users

With the capex guidance absorbed, we expect attention to return promptly to the Search business, where results were solid, but where the beginning of the DOJ antitrust remedies hearing beginning on April 22 will narrow focus (see more HERE).

Search and Other growth came in at 12.5% y/y growth in 4Q24 vs our/consensus estimates of 12.0%/11.0% as management offered incremental anecdotes on the engagement benefits of AI Overviews in Search and Circle to Search. CEO Pichai noted that search engagement continues to grow in aggregate, but (like 3Q24) there was no comment from CBO Schindler about seeing query growth in all major markets.

While we would have been more positive with more specificity on engagement/query growth (not a regularly reported metric, but one we believe investors are very interested in) we saw positives in the commentary and think the bulls can take some comfort in another quarter where AI chatbots have failed to cause a miss in search revenue.

CEO Pichai teased new features in 2025 including efforts to capitalize on users learning the use case of Google as a chat interface, including the potential benefits of follow-up questions and deeper engagement. Agents were also a hot topic, but we still see no immediate impact to numbers.

Margins beat but D&A is coming home to roost in 2025

Operating income came in at $31.0B, 1.8% ahead of consensus driven primarily by Google Services’ total of $32.8B, 3.2% ahead of Street $31.8B. While Cloud revenue was a little light, Cloud OI was 4.8% ahead at $2.1B vs our/consensus estimate of $2.1B/$2.0B. Other bets operating loss of ($1.1B) was below our ($1.7B) and slightly below Street ($1.2B).

CFO Ashkenazi called out increasing headcount and increased depreciation related to capex investments this year and last year, specifically noting that she expects depreciation growth to accelerate vs 28% y/y growth in 2024, which is in line with our pre-print forecast.

YouTube and Cloud run-rate at $110B, with YouTube TV price increase helping

Management followed-up their 3Q24 comment of expecting YouTube + Cloud revenue run rate to exceed $100BN in 4Q24, noting that the current run rate is $110B, vs our pre-print estimate of $96.5BN and 2025E estimate of ~$118B.

Key to the “current run-rate” comment is that YouTube TV’s price increase went into effect two weeks ago, though we also expect that a healthy contribution from Sunday Ticket has supported subscription growth (YouTube creatively ran a $4.99 promotion for Sunday Ticket during the last week of the season, which no doubt helped bring in a few more base plan subscribers ahead of the price increase. Put simply, YouTube TV has won the vMVPD streaming war, and this likely helped FUBO and Hulu with Live TV find common ground on a merger agreement recently.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.