Quick hit: AST and Ligado Networks announce deal

What’s new: AST has secured access to Ligado’s spectrum for direct-to-device communications in the US. This puts AST and their US carrier partners, AT&T and Verizon, in a very strong position with 50MHz+ of spectrum over the US. We touch on the implications for AST, Ligado, AT&T, Verizon, T-Mobile, SpaceX and EchoStar in this brief note.

The deal

AST will get access to Ligado’s 45MHz of spectrum (up to 40MHz of MSS licensed spectrum plus 5MHz leased from CCI). AST will pay $550MM at closing, $80MM per year, and they will split direct-to-device revenues in the US with Ligado. In addition, they will issue Ligado 4.7MM warrants worth about $110MM today.

The service

Direct-to-device communications allow regular smartphones to connect via satellite in areas not covered by terrestrial mobile networks. This would bring coverage to the 90% of the world’s surface and 400MM POPs that don’t have coverage today.

We believe the most valuable applications will be voice and broadband data. Moreover, we believe there is strong demand for the service in developed markets with near-ubiquitous coverage like the US. Our work suggests that a significant share of US consumers is willing to pay a monthly subscription to have coverage in areas where they have gaps in coverage today.

The market

We have estimated the direct-to-device market at $20BN+ in the US and $100BN+ globally.

Several companies have set their sights on the direct-to-device market. We think three things are required for any of them to succeed: 1) carrier and / or device partners; 2) a LEO constellation[i]; 3) spectrum.

We have argued that the ideal spectrum asset for direct-to-device would be global harmonized MSS spectrum in the L or the S-Band. These bands have been included in the 3GPP direct-to-device standard. In addition, the more spectrum the better.

Among those with direct-to-device aspirations in the US, we think the most credible include:

- Globalstar has partnered with Apple, they have a constellation, and they have some spectrum. They are delivering SOS services to iPhone 14s, 15s and 16s in the US and ~15 other developed markets today.

- SpaceX has partnered with T-Mobile in the US, they have by far the biggest constellation, and they have access to 10MHz of T-Mobile’s PCS G-block spectrum in the US.

- AST has partnered with AT&T and Verizon in the US, they have five satellites with plans to launch more, and they have 10MHz of the carriers' 850MHz spectrum plus up to 45MHz from Ligado in the US.

- EchoStar is a carrier, they don’t have a LEO constellation, but they do have 40MHz of S-Band spectrum in the US and 40-60MHz[ii] in markets across Europe, Australia and parts of South America.

- Amazon has neither carrier partners, a constellation, nor spectrum today. However, they have plans to launch a constellation, and they have very deep pockets.

Implications for AST

We have been skeptical of AST’s prospects, given their lack of a constellation and lack of spectrum (we didn’t think 10MHz of 850MHz would be enough to deliver voice and broadband data to all US consumers that will want it). This transaction solves one of those problems.

Securing spectrum increases AST’s prospects of success such that it should now be easier to raise the capital required to launch a competitive constellation. As such, this transaction helps solve the second problem also.

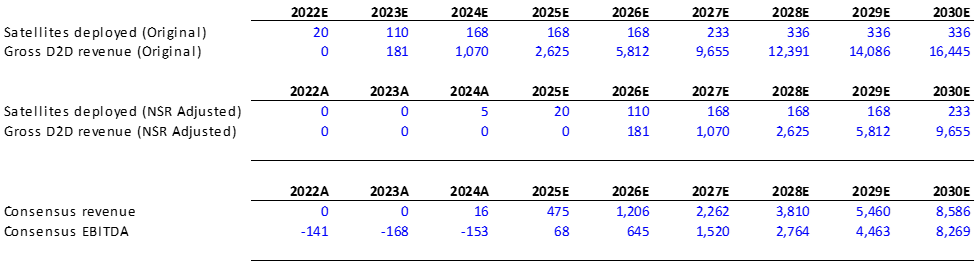

We don’t have an AST model (yet). AST has forecast revenue and EBITDA of close to $10BN annually 5 years following launch of commercial service. We would guess that close to $2BN of that would be in the US. Consensus forecasts $8.6BN of revenue and $8.3BN of EBITDA in 2030. We don’t have a view on how credible that is, but it becomes a lot more credible with access to an additional 45MHz of spectrum in the US.

Implications for AT&T and Verizon

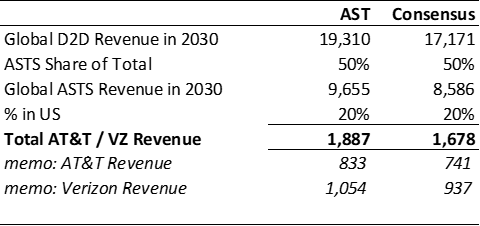

We believe AST is splitting revenues 50/50 with carriers. Based on AST’s forecast of $10BN in revenue globally, we would assume roughly 20% or $2BN is in the US. If AST receives $2BN, then US carriers should see $2BN in incremental direct-to-device revenue also. We would assume close to 100% incremental margins for the carriers.

Based on AST’s forecast, AT&T and Verizon could see close to $2BN in incremental revenue and EBITDA from direct-to-device in 2030. This assumes neither gains market share as a result of offering the service (which implicitly assumes that T-Mobile fields a competitive service). This would split into roughly $0.8BN for AT&T and $1.1BN for Verizon.

Investors won’t bake this opportunity into their forecasts for the carriers yet. We expect more excitement once the service has launched commercially, pricing is announced, and we start to see evidence of demand from consumers.

Implications for Ligado

This transaction should pave the way for Ligado to emerge from restructuring. The $550MM that they will receive upon closing the transaction will cover arrears owed to ViaSat, and the $80MM in annual payments will more than cover their ongoing lease payments to ViaSat as well as other operating expenses. The real value for Ligado comes from the revenue share opportunity.

Implications for SpaceX, EchoStar, and Amazon

The obvious move in our view is for EchoStar and SpaceX to partner on the direct-to-device opportunity globally. EchoStar brings a global spectrum portfolio; SpaceX has by far the largest and most capable global constellation. If they combined these assets, they would have a formidable asset advantage globally that would likely attract the requisite carrier partners.

The alternative for EchoStar would be to partner with Amazon. This would be less attractive because Amazon is still in the process of launching a constellation and they don’t have carrier partners (at least, not in the US). EchoStar could significantly accelerate Amazon’s ability to pursue direct-to-device, which could in turn enable EchoStar to capture a greater share of the economics than they would with SpaceX.

We believe SpaceX has been reluctant to invest in spectrum until now. This deal between AST and Ligado may change their perspective. Alternatively, sharing revenues with a partner may be more palatable than paying for spectrum. Striking a partnership between Musk and Ergen could be challenging though.

Implications for T-Mobile

T-Mobile and SpaceX received approval to use T-Mobile’s 10MHz of PCS spectrum for direct-to-device communications in December 2024. They will be offering a text-based direct-to-device service commercially in 2025. They plan to add voice and broadband capabilities in due course, though we believe they will be limited with just 10MHz of spectrum.

If SpaceX partners with EchoStar to get access to up to another 40MHz+ of spectrum, T-Mobile will have all the capacity for direct-to-device that they could want. If SpaceX doesn’t get access to more spectrum, T-Mobile could be faced with the tough choice of using more precious terrestrial spectrum for direct-to-device or potentially facing capacity limits at some point in the future.

Implications for Globalstar

This transaction doesn’t impact Globalstar, as far as we can see. Globalstar’s revenues from Apple are relatively fixed. As such, it doesn’t matter how much competition Apple faces for direct-to-device services.

Globalstar has announced that Apple will fund the launch of a new constellation and that their revenue and EBITDA from Apple will more than double with the new constellation. We don’t know whether the new constellation will be able to deliver voice and broadband data, though we would be surprised if the companies invested in a new constellation that couldn’t do both.

We also don’t know whether Apple will charge for voice and broadband data (they offer the text-based SOS service for free today). We assume they will charge for the service, given their increased investment and ongoing cost. If for some reason they don’t, it will make it harder for AST and others to monetize the opportunity.

Next steps

AST and Ligado have a binding term sheet; they need to finalize documents in the next 75 days. In addition, the deal needs to be approved by the bankruptcy court judge. Once both of these hurdles are cleared, the transaction should close. The parties will need to file for permission to operate LEOs in the band. At that point, there may be objections from ViaSat, EchoStar, SpaceX and others.

[i] Some argue that the optimal direct-to-device network would include both LEOs and GEOs. AST would have the ability to do both, in conjunction with Ligado and their spectrum.

[ii] EchoStar has the ability to use their S-Band spectrum in the US for their terrestrial network. The spectrum has much higher value as terrestrial spectrum. It is unclear how much of the 40MHz will be available for direct-to-device communications without limiting its use for terrestrial purposes. It will be many years before EchoStar has sufficient traffic on either the terrestrial network or the direct-to-device network that this will be an issue.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, Birchin Court, 20 Birchin Lane, London, EC3V 9DU. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.