The next big spectrum band: Clearer progress emerging

The next big spectrum band in Europe is the upper-6GHz band (700MHz of spectrum, ie almost 2x the 3.5GHz band). We have written a fair amount on this topic before:

- Upper 6-GHz: Further regulatory support for sector, 20 Dec 2023

- The biggest decision you haven't heard of, 25 Oct 2023

- EU Spectrum: 5G spectrum almost done. What comes next?, 29 Apr 2022

Today, Ofcom has launched a major consultation on the next steps to bring this band to market, suggesting a new approach involving WiFi sharing. In this note, we recap on the background to this band, why it is important, the likely outcome from the consultation and the next steps investors should be looking out for.

Recap: Why the upper-6GHz band is important

The upper-6GHz band (6.4-7.1GHz) has the potential to be the single largest chunk of spectrum to become available for the MNOs.

Ongoing improvements in spectrum propagation techniques mean that this spectrum could be ideal for providing urban capacity close to macro cell sites, allowing existing bands to be used in the outer edges of the cell, thereby materially increasing overall network capacity with limited incremental capex and helping them to restrict costs on future tower densification.

For MNOs who are thinking about how to grow and defend their businesses going out beyond 2030, one of the most important issues for a mobile operator is to maintain the “moat” around their business. One of the biggest “moats” that a mobile operator has is its spectrum ownership as a differentiated piece of real estate.

However, as technologies continue to evolve, the blurring between Wi-Fi/ shared access spectrum and dedicated MNO spectrum is likely to continue.

Looking at the spectrum that can be used heavily for data capacity in Europe, ie 1.8GHz to 3.9GHz, the MNOs today have c.960MHz spectrum available.

However, the shared access/ Wi-Fi bands today in Europe are already at c.1,570MHz of spectrum, ie over 60% more spectrum, including the newly opened-up lower 6GHz (5.9-6.4GHz) – which is also available for use in the latest mobile handsets. Therefore the future of the upper-6GHz band is important for the MNOs to protect their business against further WiFi encroachment.

How the upper-6GHz band in Europe would be allocated was partially decided at the World Radio Congress in December 2023 when it was recognised predominantly for mobile use, while also acknowledging its importance for WiFi. Exactly how this co-existence would play out was slightly unclear – until now.

What’s New

Ofcom today published a consultation on the use of the 6GHz band in the UK, proposing a shared use (Wi-Fi and mobile) approach for the Upper-6GHz.

This consultation is considering two alternative models for shared use:

- Prioritised spectrum split – the preferred option: Wi-Fi has priority in the lower portion of the band and mobile has priority in the upper portion of the band. Each set of users (Wi-Fi and mobile) would be able to access the other’s priority portion where it would not cause interference, i.e., it was aware that the other application was not present in the area. The exact split between the two set of users is yet to be determined, but for a band of spectrum that is 700MHz wide, Ofcom is proposing that the amount allocated to mobile should be between 300-540MHz, with correspondingly between 160-400MHz for WiFi.

- Indoor/ outdoor split - the alternative approach: Lower power Wi-Fi could be used indoors and then lower-power mobile used to provide coverage outdoors, freeing up capacity in other mobile bands to serve indoor users. In this scenario mobile power would need to be limited, while still being sufficient to allow good outdoor coverage from existing macro sites.

This is a consultation at this stage and will rely on European harmonisation, but for now Ofcom’s clear preference is to adopt the first option.

Update on the upper-6GHz regulatory process

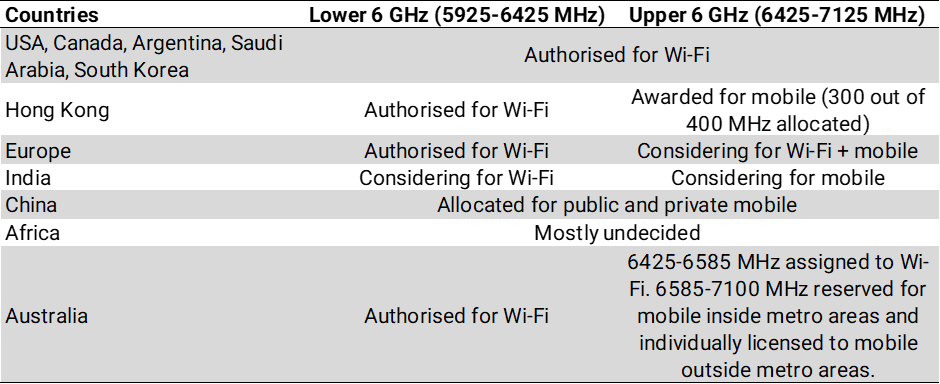

Unlike most cellular bands which are aligned globally, we continue to see varying approaches to the regulation of the 6GHz band.

Several countries have already fully assigned the whole 6GHz (from 5.9GHz up to 7.1GHz) band for Wi-Fi (incl. USA, Canada, Argentina, Saudi Arabia and South Korea). China has already assigned the Upper-6GHz band to mobile and others, such as India, are leaning this way. Europe though is yet to decide how to authorise Upper 6 GHz, though the CEPT (European Conference of Postal and Telecommunications Administrations) and European Union are working on a shared approach – like the UK.

6GHz allocation by region

We understand that CEPT and Ofcom have a strong desire to be aligned on the approach for the allocation of the upper-6GHz and CEPT, like Ofcom, has also been studying the future use of the Upper 6GHz band for some time. In early 2023 it began looking at the potential shared use of Upper 6GHz between Wi-Fi and mobile networks.

While Ofcom has published its consultation today, the European Union is due to approve a draft consultation in March, with publication in July.

The European Union mandated CEPT to investigate the possibility of sharing between the Wi-Fi and mobile and to propose harmonised technical conditions for the band. The mandate requests that final reports should be published in July 2027 but we believe that a final outcome could now come before that date.

Ofcom continues to support the shared use of the upper-6GHz band, and of the two sharing options being considered at a European level, Ofcom favours the ‘prioritised spectrum split’ (as it would allow for high-power mobile services without interfering with indoor Wi-Fi services). However, Ofcom has said that is will wait for the outcome of the European harmonisation process, and will likely align with their decision.

Next steps

In the immediate future, Ofcom is proposing a phased approach for the Uppper-6GHz:

Initial Wi-Fi access: Authorising low-power indoor Wi-Fi across the whole band on a licence exempt basis, ideally by end 2025.

Adding mobile access: Once the European band harmonisation process is clear, introducing a sharing mechanism between mobile and Wi-Fi. Assuming a ‘prioritised spectrum split’ approach is adopted, this would result in at least 300MHz of the band being prioritised for mobile.

New spectrum auctions?: At this stage it is not clear how spectrum prioritised for mobile would be allocated between the three UK MNOs. Ofcom says the spectrum would likely be authorised in high-density areas, “possibly by award” (e.g. an auction), but unlike other spectrum bands this might not be on a nationwide basis. In the lower-density areas, it keeps an open mind on how the spectrum should be authorised for the mobile operators as demand for the spectrum in these areas is likely to be lower given the weaker propagation characteristics of this band.

In our discussions with market participants over the past 12-24 months, we get the impression that our interest in the upper 6-GHz band is seen as fairly niche – but with the potential for 300-500MHz of spectrum to come to market (ie similar to the 3.5GHz band), we believe that looking beyond 2030, the outcome of this spectrum award will have a material bearing on picking potential future winners-losers in the sector – for example, could this herald a wider-rollout of more FWA services? Could this even lead to the need for fewer towers? What might the cost of this spectrum be? None of this is yet known, but we believe this topic should start to feature more heavily on people’s radar screens and isn't so niche after all.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.